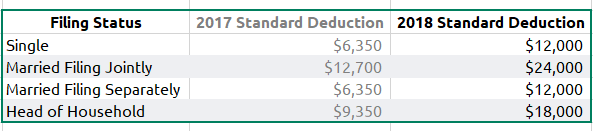

2018 Marginal Income Tax Rates and Brackets

Revised Income Brackets and Marginal Tax Rates What are marginal tax rates? It’s the percentage of your income that you pay in taxes. Good news –the brackets (or income ranges) were lowered so most of us will be paying 2-3% less income tax. Find your annual income range and the associated percentage you’ll pay below

Example: If you are single making $50,000/year you are in the 22% tax bracket

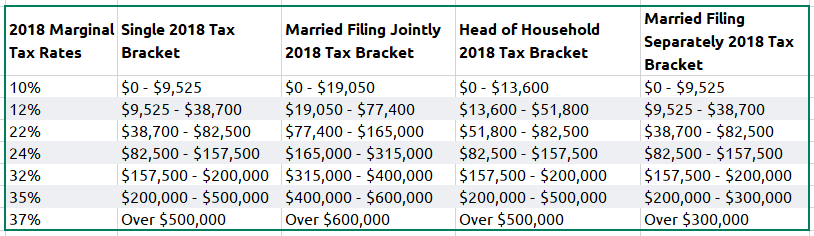

Standard Deduction 2017 compared to 2018

The standard deduction was almost doubled to simplify the process and encourage less people to itemize their deductions. The 2018 tax reform bill got rid of the personal exemptions. To see what was eliminated click here.