By Margery K. Schiller, CFP®

When thinking of investing for retirement, there’s many variables to consider. How to maximize earnings and minimize risk? In this article, Savvy Ladies volunteer Margery K. Schiller, CFP®, shares expert tips to make the smartest decisions for your retirement plan.

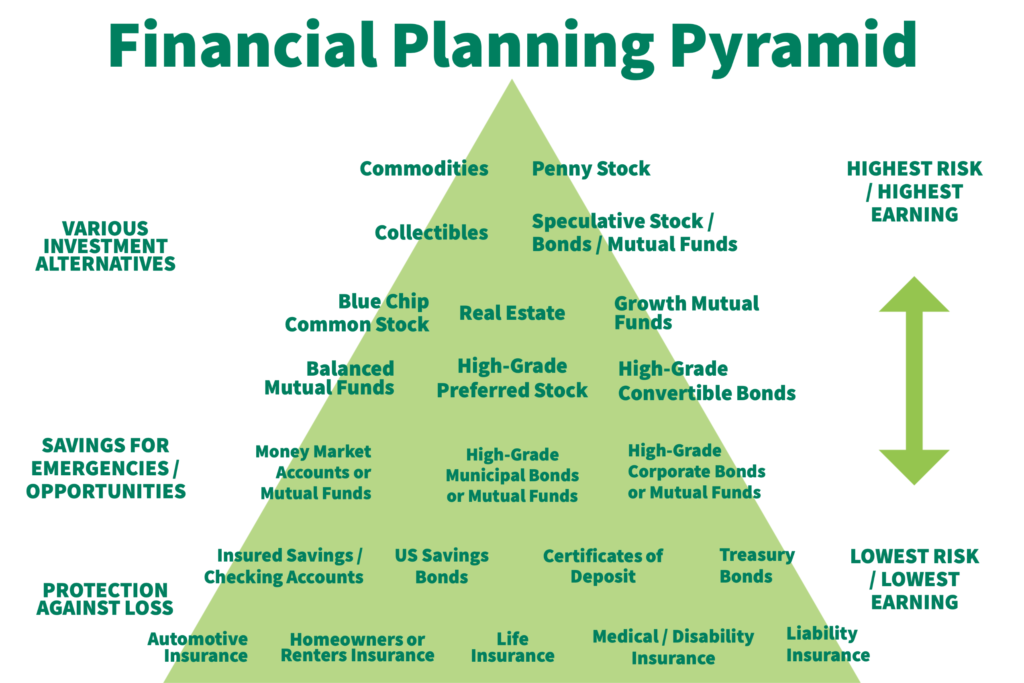

The Investment Pyramid

The investment pyramid below was invented decades ago to help individuals make informed choices about where to put their money. This illustration was designed as a snapshot of your potential choices.

It basically says:

- Begin near the base of the pyramid as you start investing and make safe choices like a bank or credit union account that keeps this money intact and readily available to you, if needed for emergencies.

- After you accumulate this emergency reserve (equal to 3-6 months spending needs), you can move up the pyramid. The next step up is bonds. They are loans that you make to governments or corporations in exchange for interest payments for a period of time. While the value of the bond can change during this period of ownership if you sell it early, bonds held to maturity return the dollars you invested plus interest in most cases.

- Stocks are the next step up the pyramid. They are shares of ownership in corporations. They can be more profitable than bonds since the stockholders share in corporate profits and growth. However, the value of a stock goes down as well as up, so owners need to be willing and able to ride out the bumps in this road through good and bad times in the economy.

- Mutual funds are groupings of investments mixed together by professionals who manage the accounts for you for a fee. They are the usual choices within a group retirement plan. You need to understand their mix of investments to choose wisely since mutual funds can offer stocks, bonds, cash or a blend of all of them. Mutual funds can also own real estate and/or commodities (like gold and silver). Their risk level is dictated by the underlying investments they choose. The fees for managing these investments are decided by each mutual fund company.

Retirement Plans: How Much Risk Should You Take?

Your employer’s retirement plan generally allows each employee to choose among the variety of investments listed for the account. You do not need to own all of them. You can choose based upon your comfort level with risk:

- Young investors with several decades until they retire can generally tolerate the risks of the stock market since they are not planning to withdraw from this account in the near future. They can choose an all stock investment in the hopes of good growth rates and higher returns on their investment.

- Middle age investors may be less comfortable with the ups and downs of an all stock account since retirement is closer. They can be better served by a blend of stocks and bonds. The easy choice here would be a balanced mutual fund that holds both stocks and bonds. If that is not available, they may have to invest a percentage of the account into stock funds and the rest into bond funds to achieve their preferred mix.

- Older investors can be comfortable with this balanced approach even during retirement since life expectancy is usually well beyond the start of retirement. They can choose to modify the mix with less stock and more bonds but still keep a mix of both.

Low-risk investments

Risk averse investors and those with limited resources may be better served with investments in short term bonds or cash so the principal is safe at all times. That keeps them anchored at the base of the pyramid if it provides greater peace of mind. The tradeoff is a potentially longer time to save enough to reach their goals.

What if I don’t make a selection on my retirement plan?

Sometimes there is an automatic investment choice made by your employer if you do not make a timely choice on your own. This is generally a target date fund that blends stocks and bonds for you, reducing stock exposure gradually as you age. This is a reasonable choice to simplify decision making.

What if I don’t have an employer retirement plan?

If you do not have an employer retirement plan, you can open an IRA to save for retirement. You can invest in a similar manner to that noted above. You can even shop for low cost versions of these investment choices since you are in charge of these decisions here.

Should you leave your job, you can generally keep your retirement account with this employer, possibly merge it into your new employer’s retirement plan or complete an IRA Rollover to invest it as you choose. The best decision depends upon your specific choices.

For those of you interested in learning more about investments to make better decisions, go to www.morningstar.com/cover/classroom.html for free lessons on the jargon of investing and how to choose wisely. You can also contact the Savvy Ladies Free Financial Helpline to discuss your choices with one of our experienced volunteers.

Margery K. Schiller, CFP®

Margery K. Schiller, CFP®

Savvy Ladies volunteer