Virtual group sessions with industry experts to educate yourself on a wide range of topics in detail. View our extensive webinar library to educate yourself now or join the live conversation by registering for one of our upcoming sessions.

Webinar Library

I want to watch a video webinar about…

Credit Confident Series

Looking to improve your credit score but not sure where to start? Watch our recent 3-part workshop series designed to help you take charge of your financial future, led by credit expert, Catherine Dolsen and budgeting enthusiast, Martina Davis from Synchrony. Over the...

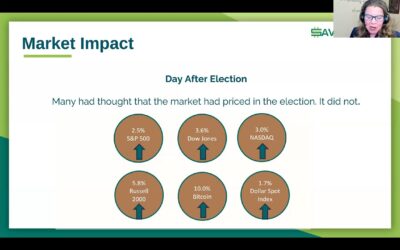

Savvy Ladies – What a Trump Presidency Means for Your Money with Stacy Francis

Stacy Francis, Founder of Savvy Ladies, explains what the market and your money in easy terms as she unpacks the impact of what a Trump Presidency means for your money. Recorded November 14, 2024.

Investing in the Life You Want

An empowering conversation with female financial thought leaders discussing professional development and career growth. Recorded September 17, 2024.

Women, Money & Well-being

Featuring industry leaders addressing the link between your emotional health and money mindset. Moderated by Beth Pinsker. Recorded June 12, 2024.

Financial Wellness & Health Money Mindset

Experts share their financial journeys, practical tips for building financial confidence, and navigating financial challenges like divorce. Learn how to create your own money board, use resources like social media responsibly, and the importance of a growth mindset. Tune in for valuable insights and advice to reduce financial anxiety and build financial confidence.

How to Build Generational Wealth for Yourself & Family

View the webinar with expert insights on investing, income streams, & building generational wealth with Chris Blakely, CFP®, & Shannon Paul. Recorded May 1, 2024.